Wise plc (LON:WISE), which recently listed on the London Stock Exchange, today provided a trading update for Q1 FY2022.

A total of 3.7 million customers transacted on Wise in the first quarter of financial year 2022. Despite ongoing lockdowns across many countries worldwide, the number of personal customers grew by 28% year on year to reach 3.4 million. Business customers, who typically use Wise for a broader range of needs such as paying and receiving funds from suppliers, vendors and customers, grew by 56% compared to the prior year.

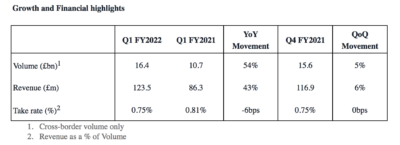

Volume grew by 54% YoY to £16.4 billion, faster than the growth in customers. This was mainly driven by the average volume per customer, which was significantly lower (19%), in the first quarter of last year due to the impact of the COVID-19 pandemic on customer demand for international payments, but quickly rebounded and has been broadly stable since.

Revenue grew at 43% YoY to reach £123.5 million in Q1 FY2022, in line with Wise’s expectations. This growth in revenue was outpaced by year-over-year volume growth as certain higher-priced routes returned to longer-term average levels of activity and a lower proportion of overall volumes. This is reflected in the 6bps reduction in the take rate.

Compared to the prior quarter, the number of active personal customers using Wise grew by 3%, while the growth in business customers maintained its strong momentum, increasing 9% quarter-on-quarter. With a greater proportion of business customers sending larger and more frequent payments, the overall volume per customer for Wise increased by 2% quarter-on-quarter.

As a result of the growth in customers and uptick in average volume per customer, volume increased by 5% quarter-on-quarter and revenue by 6%. The take rate was stable compared to the prior quarter as a 2bps reduction in conversion fees was offset by additional fees from the adoption of the Wise account.

Kristo Käärmann, Co-Founder & CEO, commented:

“Wise’s mission is to make moving and managing money across borders faster, easier, cheaper and more transparent for everyone, everywhere. In the first quarter of this financial year we continued to take important steps forwards towards this goal while also successfully listing Wise on the London Stock Exchange.

“We were pleased that in the first quarter of this financial year we were able to reduce pricing by 2bps to 0.67%, dropping prices for 19 currencies while also delivering 38% of all transfers instantly. Our financials in that period were in line with our expectations with revenues of £123.5m, representing a growth of 43% YoY compared to Q1 FY2021.

“As we enter the next phase of our growth to tackle the problem of the £150 billion the world continues to pay in hidden fees each year, we’re focused on doing so reliably and sustainably, so our customers know they can count on us for the long term.”