The Charles Schwab Corporation (NYSE:SCHW) has just posted its financial report for the final quarter of 2021, with the data revealing record profits for the three months to end-December 2021.

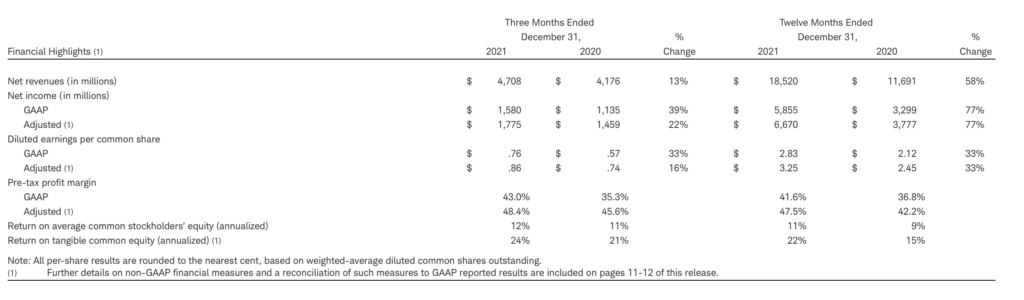

Net income for the fourth quarter of 2021 was a record $1.6 billion compared with $1.5 billion for the third quarter of 2021, and $1.1 billion for the fourth quarter of 2020. Net income for the twelve months ended December 31, 2021 was a record $5.9 billion, compared with $3.3 billion for the year-earlier period.

The company’s financial results include TD Ameritrade from October 6, 2020 forward, as well as certain acquisition and integration-related costs and the amortization of acquired intangibles. For the fourth quarter and the twelve months of 2021, these transaction-related expenses totaled $255 million and $1.1 billion, respectively, on a pre-tax basis.

CFO Peter Crawford noted that fourth quarter net interest revenue increased 18% over the year-earlier period, as strong asset gathering helped lift investment portfolio balances while client utilization of our range of lending products continued to expand. Asset management and administration fees were up 12% year-over-year due to rising balances in advisory solutions, as well as proprietary and third-party mutual funds and ETFs.

Including 19% growth in trading revenue driven by higher activity levels, total fourth quarter revenues were up 13% to $4.7 billion.

Total GAAP spending was essentially flat versus a year ago at $2.7 billion, which included $101 million in acquisition and integration-related costs and $154 million in amortization of acquired intangibles. Adjusted total expenses were up 7% year-over-year, reflecting robust client engagement and business growth, as well as the 5% employee salary increase that went into effect at the end of September.

Strong revenue growth and disciplined expense management enabled Schwab to produce a 43.0% pre-tax profit margin for the fourth quarter – 48.4% on an adjusted basis – and helped its full-year margins reach 41.6% and 47.5%, respectively.

Schwab’s balance sheet expanded to end 2021 with total assets of $667 billion, up 22% versus December 31, 2020. Last year’s increase was driven primarily by client asset flows, as well as approximately $10 billion in bank deposit account migrations. The company also added a net $10.2 billion to outstanding debt largely for liquidity management purposes, and increased preferred stock by $2.3 billion to help support continued business growth.

CEO Walt Bettinger commented:

“Investors remained actively engaged with the markets throughout the year, and our competitive positioning as a trusted financial partner offering both value and service continued to resonate in the marketplace. While some measures of engagement eased from the extraordinary levels seen during the first quarter 2021 ‘re-opening’ surge, activity generally exceeded the fourth quarter of 2020, when we included TD Ameritrade in our results for the first time, and core net new assets set yet another record over the final three months of 2021 at $162.2 billion.

Clients brought us $80.3 billion in December alone, 28% above our prior single-month record, and our full-year total of $558.2 billion represents an 8% annual organic growth rate. We ended the year with $8.14 trillion in client assets across 33.2 million brokerage accounts, increases of 22% and 12%, respectively.”

Mr. Bettinger concluded, “Following four recent acquisitions, including the largest brokerage transaction in history, I’m particularly proud of our progress in uniting as a single team, pulling in the same direction through challenge after challenge, supporting each other and our clients as we pursue Chuck Schwab’s vision. I share his excitement and passion for our combined organization’s potential, and remain convinced we have the talent, culture, and client-first strategy needed to pursue the tremendous growth opportunities ahead of us.”

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Pretty! This has been a really wonderful post. Many thanks for providing these details.

Si su esposo eliminó el historial de chat, también puede usar herramientas de recuperación de datos para recuperar los mensajes eliminados. A continuación se muestran algunas herramientas de recuperación de datos de uso común: https://www.xtmove.com/es/how-do-i-see-text-messages-from-my-husband-on-my-phone/

The fate of the kingdom rests in your hands! Lucky cola

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.