In this post, we tell you what the difference is between MT4 and MT5 so that you can choose the option that best suits your needs.

Introduction of MT Platform

MetaQuotes Software Corp. developed the first trading platforms to trade Forex, CFDs, stocks, and futures in 2000 and 2001. They had relatively few capacities of the trader terminal and didn‘t become popular among traders. In early 2002, the company presented MetaTrader 3, where the programming language and functions’ capabilities were significantly expanded. This trading platform existed for three years.

In 2005, software development company MetaQuotes developed the MetaTrader 4 that has been the most popular trading platform since then due to its multifunctionality and ease of use.

Between 2007 and 2010, a number of brokerages added the MT4 platform as an optional alternative to their existing trading software due to its popularity with traders and the large number of third party scripts and advisors.

In 2010, MetaQuotes released a successor, MetaTrader 5. However, uptake was slow and as of April 2013 most brokers still used MT4.

MetaTrader 4

The MT4 was initially designed for forex retail trading. The MetaTrader 4 is so popular because it is multi-functional, user-friendly, and mobile. MT4 has certain features that will really improve beginner trading skills if used correctly.

MetaTrader 4 has an intuitive interface; it is not overloaded with ample information, panels, and buttons. MT4 graphics make reading very easy and do not need to master how to use various graphical tools and objects on the platform. Terminal windows are loaded with tabs which are pure assets: news bars for trading news and Market tabs, Base Codes and Signals to access resources in the MQL4 Community.

MetaTrader 5

MT5 is a revised, state-of-the-art multi-asset platform. The MetaTrader 5 was first released in June 2010. There is still a lot of confusion about what Metaquotes wants to do with MT4 and MT5.

At some point, the MetaQuotes even decided to abandon the MT4 support and stop selling licenses to promote the new terminal modification. But MT5 found it difficult to achieve the type of market penetration that MT4 acquired, so MetaQuotes decided to use both versions. Some forex brokers have tried to encourage the use of MT5 by only allowing certain trading assets on MT5.

Comparison Between MT4 And MT5 Platforms

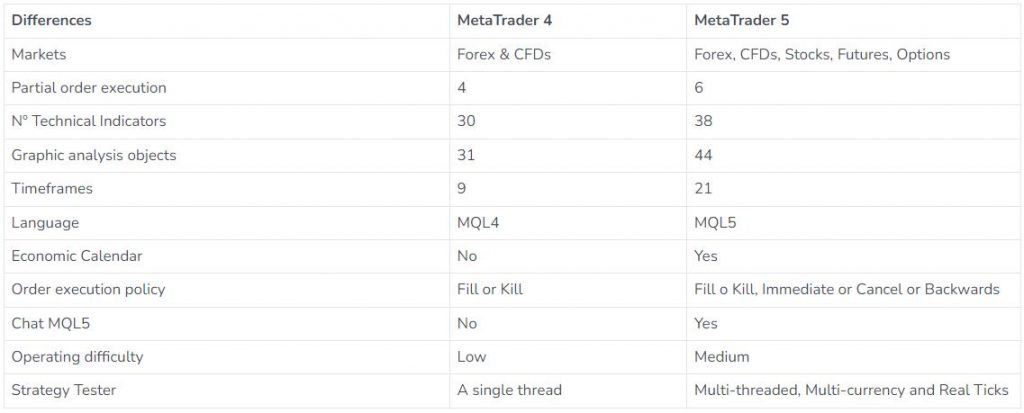

These two platforms are pretty different from each other, there are a number of comparisons between the two packages worth understanding.

1. Speed

MT5 is faster than MT4. It doesn’t slow down your platform. It is a fully fledged 64-bit, multi-threaded platform, whilst MT4 is a 32-bit, mono-threaded platform with a 2GB (or a 4GB memory limit if you use it on a 64-bit operating system). MT5, being the latest version of the software, runs excellent on 64-bit operating systems, whereas MT4 is ideal for a 32-bit operating system.

2. Amounts of Technical Indicators

There are 30 trading indicators available in MT4 where in MT5, there are 38. Both MT4 & MT5 allows custom indicators from Metaquotes website or personally made. MT4 has 31 graphical tools, while MT5 has 44 graphical tools.

3. Order types

MT4 allows for two types of market orders, four types of pending orders, two different execution modes, two stop orders, and a trailing stop function. It is still easy to navigate through it, and many traders simply love to use it.

MT5 offers 6 types of pending orders, The additional two orders provided in this program are the buy/sell stop limit.

4. Timeframes

There are 9 Timeframes in MT4, while MT5 features 21 timeframes. The 21 timeframes are not a big deal for a novice trader. But for advanced traders, it creates the opportunity to monitor the price actions from various angles. This multiple minute chart is suitable for scalping strategy while the multiple Hourly charts are suitable for swing traders.

5. Order execution

There are three types of order execution in MT4: instant execution, request execution and market execution. In MT5, there are some more types of order execution, which a trader can specify in the order window: Fill or Kill, Immediate or Cancel, In this case, the order is not executed and Return.

6. Depth of Market (DOM) data

The DOM data displays the corresponding information about buyers‘ and sellers’ nearest orders with a step of a price change and real volume of orders at specified quotes. n MetaTrader 4, the DOM is hardly useful and is rarely employed. In MetaTrader 5, the DOM is a real trading tool. Developers added volumes that are clear in trading stocks.

7. Real Volume Data

In MT4, traders are unable to know the real trading volumes like contracts or lots. They can only assess the tick volume data. The tick volume is the number of price changes on a particular candlestick bar.

In MT5, traders have access to real volume-traded data, and not only tick volume data. After pressing the right click of the mouse from the chart, this option will appear.

8. Economic Calendar

If you trade using fundamental analysis, this feature on the MT5 will be an indispensable tool for you. This is where you can find publications and resources based on economic news from a countrys financial market or various macroeconomic indicators.