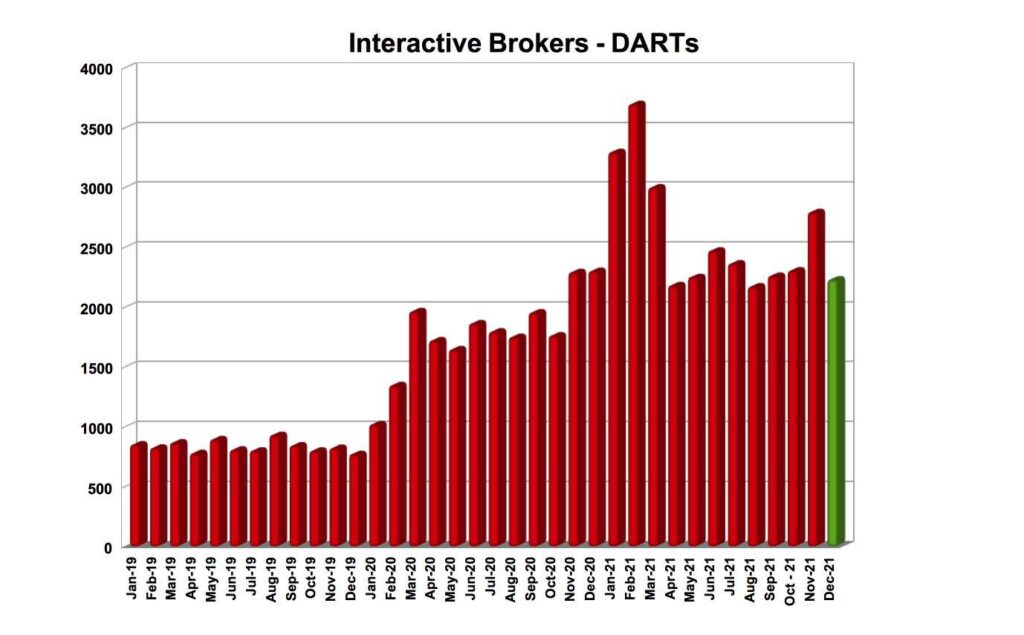

Online trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just published its key operating metrics for December 2021, with trading volumes down in both annual and monthly terms.

Interactive Brokers reported 2.229 million Daily Average Revenue Trades (DARTs), 3% lower than prior year and 20% lower than prior month, when DARTs were 2.793 million.

Ending client equity amounted to $373.8 billion in December 2021, 30% higher than prior year and about even with the level registered in November 2021. Ending client margin loan balances reached $54.6 billion last month, 40% higher than prior year and about even with prior month.

The number of client accounts was 1.68 million in December 2021, 56% higher than prior year and 2% higher than prior month.

Regarding Interactive Brokers’ performance, let’s note that the broker reported diluted earnings per share of $0.43 for the third quarter of 2021 compared to $0.58 for the equivalent period in 2020, and adjusted diluted earnings per share of $0.78 for this quarter compared to $0.53 for the year-ago quarter.

Net revenues were $464 million in the third quarter of 2021, down from $548 million a year earlier.

Income before income taxes was $234 million for the third quarter of 2021, compared to $334 million for the same period in 2020.

Commission revenue increased $32 million, or 11%, from the year-ago quarter on the back of higher customer stock and options trading volumes.

Net interest income increased $79 million, or 41%, from the year-ago quarter thanks to higher margin loan balances and strong securities lending activity.

Dear immortals, I need some wow gold inspiration to create.

guodi-tech.net Gas Compressor guodi-tech.net.

Ver el contenido del escritorio y el historial del navegador de la computadora de otra persona es más fácil que nunca, solo instale el software keylogger. https://www.xtmove.com/es/how-do-keyloggers-secretly-intercept-information-from-phones/

Discover new worlds and epic challenges! Lucky cola