We know that support areas are areas where asset prices tend to stop falling, and resistance areas are areas where prices stop rising, but traders need more information before trying to make decisions based on areas on a chart.

Using Trendlines

EURUSD 1-Minute Chart with Various Types of Support and Resistance.PHOTO:MT4

Support and resistance are highlighted with horizontal or angled lines, called “trendlines.” If the price stalls and reverses in the same price area on two different occasions in succession, then a horizontal line is drawn to show that the market is struggling to move past that area.

In an uptrend, the price makes higher highs and higher lows. In a downtrend, the price makes lower lows and lower highs. Connect the highs and lows during a trend. Then extend that line out to the right to see where the price may potentially find support or resistance in the future.1

These simple lines highlight trends, ranges, and other chart patterns. They provide traders with a view of how the market is currently moving and what it could do in the future.

Major and Minor Support and Resistance Levels

Minor support and resistance levels don’t hold up. For example, if the price is trending lower, it will make a low, then bounce, and then start to drop again. That low can be marked as a minor support area, because the price did stall out and bounce off that level. But since the trend is down, the price is likely to eventually fall through that minor support level without much problem.

Areas of minor support or resistance provide analytical insight and potential trading opportunities. In the example above, if the price does drop below the minor support level, then we know the downtrend is still intact. But if the price stalls and bounces at or near the former low, then a range could be developing. If the price stalls and bounces above the prior low, then we have a higher low, and that is an indication of a possible trend change.

Major support and resistance areas are price levels that have recently caused a trend reversal. If the price was trending higher and then reversed into a downtrend, the price where the reversal took place is a strong resistance level. Where a downtrend ends and an uptrend begins is a strong support level.

When the price comes back to a major support or resistance area, it will often struggle to break through it and move back in the other direction. For example, if the price falls to a strong support level, it will often bounce upward off it. The price may eventually break through it, but typically it retreats from the level a number of times before doing so.2

Trading Based on Support and Resistance

trading based off support and resistance

The basic trading method for using support and resistance is to buy near support in uptrends or the parts of ranges or chart patterns where prices are moving up and to sell/sell short near resistance in downtrends or the parts of ranges and chart patterns where prices are moving down.

It helps to isolate a longer-term trend, even when trading a range or chart pattern. The trend provides guidance on the direction to trade in. For example, if the trend is down but then a range develops, preference should be given to short-selling at range resistance instead of buying at range support. The downtrend lets us know that going short has a better probability of producing a profit than buying. If the trend is up, and then a triangle pattern develops, favor buying near support of the triangle pattern.3

Buying near support or selling near resistance can pay off, but there is no assurance that the support or resistance will hold. Therefore, consider waiting for some confirmation that the market is still respecting that area.

If buying near support, wait for a consolidation in the support area, and then buy when the price breaks above the high of that small consolidation area. When the price makes a move like that, it lets us know the price is still respecting the support area and also that the price is starting to move higher off of support. The same concept applies to selling at resistance. Wait for a consolidation near the resistance area, and then enter a short trade when the price drops below the low of the small consolidation.

When buying, place a stop loss several cents (or ticks or pips) below support, and when shorting, place a stop loss several cents, ticks, or pips above resistance.

If you’re waiting for a consolidation, place a stop loss a couple cents, ticks, or pips below the consolidation when buying. When selling, the stop loss goes a couple cents, ticks, or pips above the consolidation.

When entering a trade, have a target price in mind for a profitable exit. If buying near support, consider exiting just before the price reaches a strong resistance level. If shorting at resistance, exit just before the price reaches strong support. You can also exit at minor support and resistance levels. For example, if you’re buying at support in a rising trend channel, consider selling at the top of the channel.

In some cases, you may be able to extract more profit if you let a breakout occur, instead of selling at minor support/resistance. For example, if you’re buying near triangle support within a larger uptrend, you may wish to hold the trade until it breaks through triangle resistance and continues with the uptrend.

Old support can become new resistance or vice versa. This isn’t always the case, but does tend to work well in very specific conditions, such as a second chance breakout.

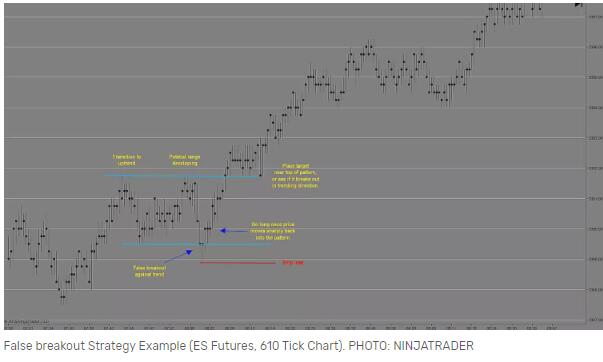

False Breakouts

Asset prices will often move slightly further than we expect them to. This doesn’t happen all the time, but when it does it is called a “false breakout.” If our analysis shows that there is support at $10, it is quite possible that the price could drop through $10, to $9.97 or $9.95 for example, and then start to rally again. Support and resistance are areas, not an exact price. Expect some variability in how the price acts around support and resistance. It is unlikely to stop at the exact same price as before.

False breakouts are excellent trading opportunities. One strategy is to actually wait for a false breakout, and enter the market only after it occurs. For example, if the trend is up, and the price is pulling back to support, let the price break below support and then buy when it starts to rally back above support.4

Similarly, if the trend is down, and the price is pulling back to resistance, let the price break above resistance, and then short-sell when the price starts to drop below resistance.

The downside to this approach is that a false breakout won’t always occur. Waiting for one means that good trading opportunities could be missed. Therefore, it is typically best to take trading opportunities as they come. If you happen to catch the odd false breakout trade, that’s a bonus.

Because false breakouts occur on occasion, the stop-loss should be placed a bit of distance away from support or resistance, so that the false breakout isn’t likely to hit your stop-loss position before moving in your anticipated direction.

Adapting Trading Decisions to New Support and Resistance Levels

Support and resistance are dynamic, and so your trading decisions based on them must also be dynamic. In an uptrend, the last low and last high are important. If the price makes a lower low, it indicates a potential trend change, but if it makes a new high, that helps confirm the uptrend. Focus your attention on the support and resistance levels that matter right now. Trends often encounter trouble at strong areas. They may eventually break through, but it often takes time and multiple attempts.

Mark major support and resistance levels on your chart, as they could become relevant again if the price approaches those areas. Delete them once they are no longer relevant—for example, if the price breaks through a strong support or resistance area and continues to move well beyond it.

Also mark the current and relevant minor support and resistance levels on your chart. These will help you analyze the current trends, ranges, and chart patterns. These minor levels lose their relevance quite quickly as new minor support and resistance areas form. Keep drawing the new support and resistance areas, and delete support and resistance lines that are no longer relevant because the price has broken through them.

If you’re day trading, focus on today, and don’t get too bogged down with figuring out where support and resistance were on prior days. Trying to look at too much information can easily result in information overload. Pay attention to what is happening now, and mark today’s support and resistance levels as they form.

Trading off support and resistance takes lots of practice. Work on isolating trends, ranges, chart patterns, support, and resistance in a demo account, and then practice taking trades with targets and stop-losses. Only once you are profitable for several months with your support-and-resistance trading method should you consider trading with real money.