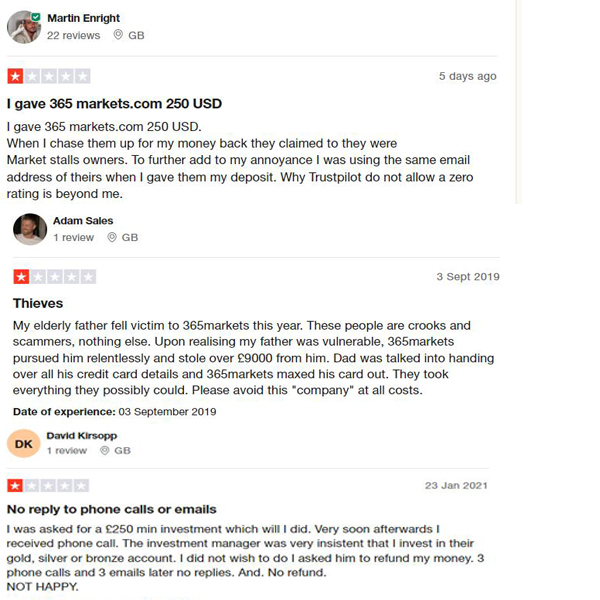

When you see FxMarket365 reviews on Brokersview platform, you know it’s a scam。

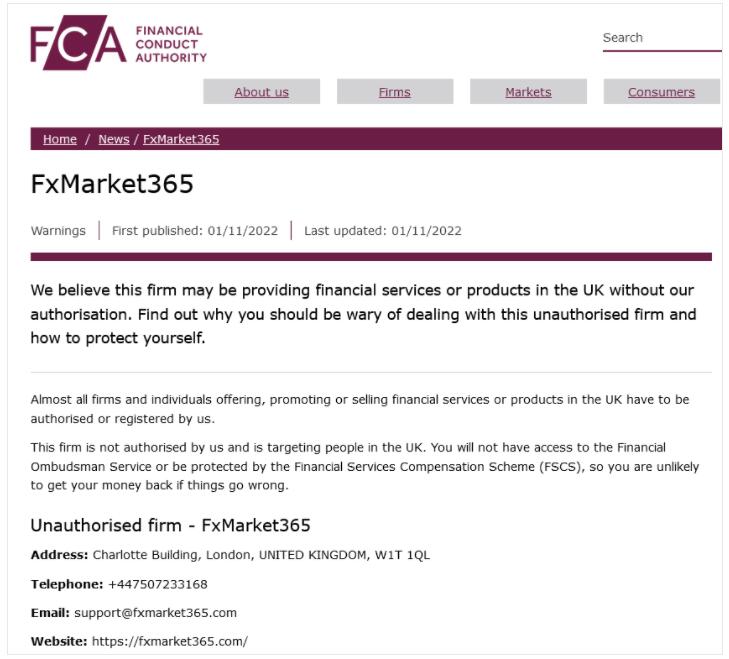

In order to operate as a forex broker in this jurisdiction, a company needs a licence from the Financial Conduct Authority (FCA). But we find no licence in the regulator’s database, but a warning that FxMarket365 is not authorised:

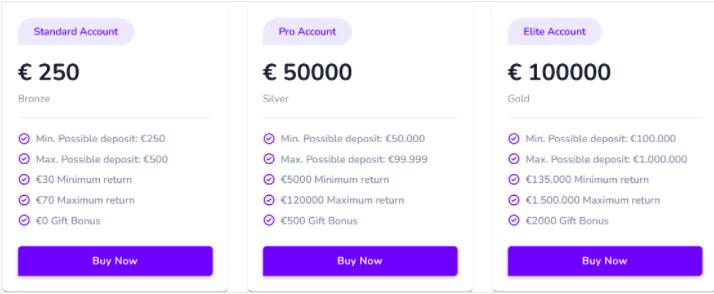

FXMARKET365 TRADING CONDITIONS

When you visit the website of a legitimate broker you will find proposals for different types of trading accounts suitable for investors with different preferences, as well as detailed descriptions of trading parameters – minimum deposit, order execution method, tradable financial instruments, leverage, spread, swap, commissions, etc.

Instead, the descriptions of the FxMarket365 account types include only information on minimum deposits and claims of guaranteed and high investment returns.

A genuine broker will not and cannot promise you guaranteed profits. In fact, licensed companies are obliged by regulators to warn their clients about the high risk of losses when trading financial instruments.

The website specifies a minimum deposit of 250 EUR, but the dashboard specifies 100 EUR and the deposit menu itself accepts a minimum of 50 EUR. Such inconsistencies are typical of fraudulent websites. Many licensed brokers offer novice traders starter accounts with very low minimum deposits, sometimes as low as 5 currency units.

FxMarket365 also claims to offer cryptocurrency trading and promises bonuses. Both of these practices are prohibited by the FCA, so this is further evidence that FxMarket365 could not be a licensed broker based in the UK.

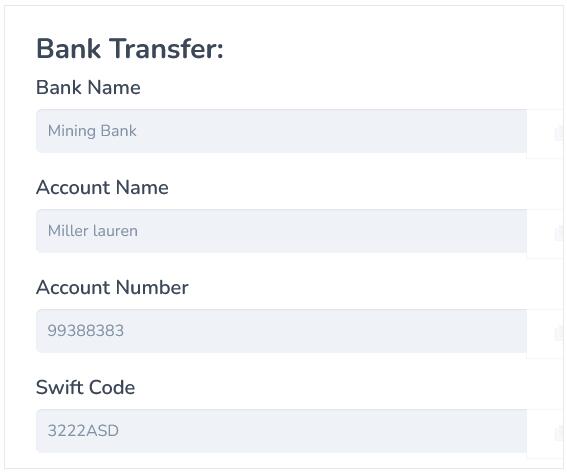

FXMARKET365 DEPOSIT/WITHDRAW METHODS AND FEES

In the FxMarket365 deposit menu we see many options, but the only really active ones are cryptocurrencies and bank transfer to a personal account.

What both methods have in common is that they do not allow for a refund or a chargeback to be requested. This makes them convenient for financial fraudsters. Legitimate brokers typically offer clients a wide choice of transparent payment methods, including credit/debit cards and established e-wallets such as PayPal, Skrill, Neteller and Sofort.

The lack of a publicly available Terms and Conditions or Client Agreement means that scammers may have set many traps such as hidden fees and impossible-to-meet withdrawal terms.

HOW DOES THE SCAM WORK

Unfortunately, the internet is full of scammers. In the age of cryptocurrencies, many of them pretend to be brokers and take advantage of people’s desire to get rich easily through financial instruments they don’t really understand.

Fake brokerage sites lure you in with promises to take on all the difficult and confusing aspects of investing for you. If you make contact with such sites, they will first convince you to make a small, “risk-free” investment of a few hundred dollars. Experienced scammers will then begin to persuade you to “invest” more and more money, and will even deceive you into believing that your initial investment is generating incredible profits.

But you will never see those profits or the money you deposited. These scammers hide behind fake names and offshore shell companies that are not subject to oversight and regulations like regulated brokers. They use cryptocurrencies or other shady payment methods that make refunding money difficult or often impossible. The terms and conditions of these sites are riddled with pitfalls that block withdrawals with impossible-to-fulfil conditions for minimum traded volume and extremely high fees reaching 10, 20 or more percent of the amount.

WHAT TO DO WHEN SCAMMED

If you find yourself in such a situation, you should be very careful not to fall into the clutches of other fraudsters while trying to recover your money. Offers from people on the internet who promise to get you your money back from scammers for an upfront fee are also one hundred percent scammers.

If you used a credit or debit card for the transactions to the scammers, there is some chance you can get your money back by requesting a chargeback. Visa and MasterCard allow this to be done within 540 days. But such a claim can be challenged if you have provided the scammers with documents such as a copy of your ID and proof of address.