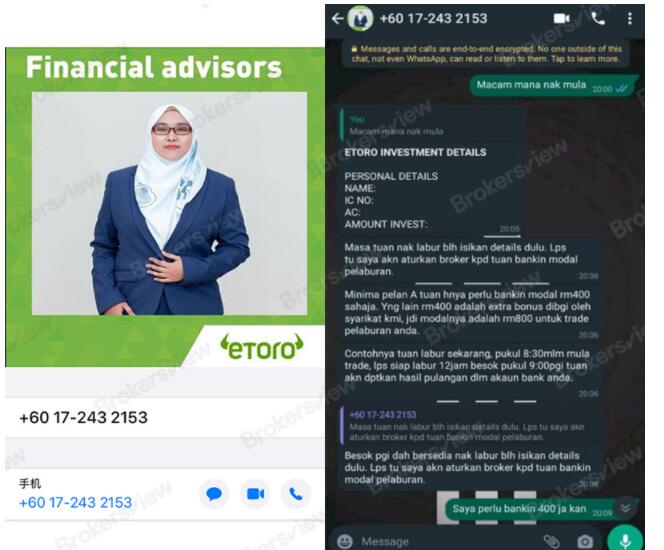

According to the victim, she is a student in her early twenties, with no investment experience, and was planning to invest because she saw an eToro (fake) investment ad on Facebook.

A person claiming to be a financial advisor of the company briefly introduced the so-called packaged investment plan: a client who deposits RM400 will receive a bonus of RM400; in other words, a client who invests RM400 will be able to trade with a principal of RM800. You don’t need to do the trading operation by yourself after making the deposit, since the company has staff to trade on your behalf. After starting to trade, it only takes 12 hours for the income to be credited at the earliest.

After that, the victim sent RM400 to a designated account, and the principal amount of the account was indeed shown as RM800.

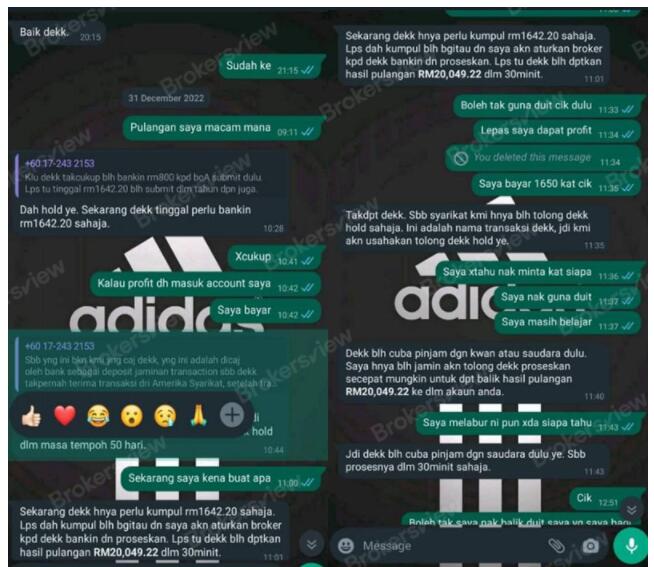

After a few trades, her account soon made a profit of RM15,988.2! The scammer said that the student would have to pay the trader a commission of RM1598.82, 10% of the profit, which sounds reasonable. So she transferred the money to the fraudster without much hesitation.

Later, the scammer suggested that since the client’s account has never received any transaction from the United States, she need to deposit RM800 to BOA and let the bank hold the “security deposit” for 50 days. The deposit would be returned to her account after the bank approved the transaction, and the total profit received would be 20049.22 ringgit. Again, she transferred another RM800 to it.

A few days later, the fraudster said that the RM20,049.22 in the account could be quickly withdrawn within 30 minutes, but a fee of RM1,642.20 need to be paid first. The girl said she could not get that much money and suggested paying the fee after her account was credited. However, the suggestion was turned down.

The scammer urged the victim to borrow some from friends or relatives.

The student could not afford it and thought that the trades have been made much more than her expectations, so she decided to give up the deal, and intended to take out all the principal he had deposited. Surprisingly, her request was refused by the broker! The fee of RMRM1,642.2 still needs to be paid to quit!

Although the victim kept telling the advisor that she was in a difficult situation, the other party remained indifferent and just kept urging her to send money.

It is worth mentioning that during the whole investment process, the victim never saw her account! All the trades were relayed to her by the advisor.

Fraudulent Financial Promotions Proliferate

In recent years, there has been a proliferation of fraudulent financial promotions on social media, with an increasing number of financial ads targeting young people, especially students. The FCA, the UK’s financial regulator, has been aware of this concern since last year, raising the requirements for financial advertisements and stepping up its efforts to crack down on false financial advertising. However, much harmful investment advertisements still exist in the market.

As an investor, especially a novice, it is important to know the market situation, the qualifications of the brokers, and the financial instrument you are investing in, so as not to put your money into the pockets of fraudsters for nothing.