But as a scammer, BBanc can’t possibly be an award-winning broker as it describes on its homepage. We will tell you the reasons.

Risky Leverage

BBanc claims that it can offer traders ultra-low spreads and leverage up to 1:500. For earning more profits at one time, many investors prefer brokers that provide high leverage like BBanc. But high returns often come with high risks. This is the reason why financial regulators impose strict limits on the leverage offered by the brokers they regulate.

Two Warnings Within a Month

Bbanc claims that it is owned and operated by Primis LLC, a company registered with the Financial Services Authority of Saint Vincent and the Grenadines (SVG FSA) under registration number 1860 LLC 2022, and authorized and regulated by the Island of Moheli. However, no forex regulators on the Island of Moheli.

There is an SVG FSA registered company matched. Nevertheless, SVG FSA does not authorize foreign exchange supervision or accept complaints. Investors’ funds can not be protected by laws even though the broker has registered with SVG FSA.

What’s more, BBanc has also recently caught the attention of regulators in Europe.

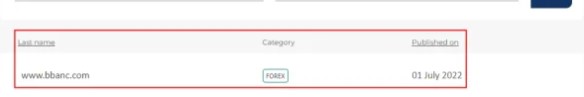

On 1 July 2022, the France Financial Authority (AMF) added BBanc to its forex black list, confirming BBanc was not authorized to provide forex services or products in France.

On 1 August 2022, BBanc was warned by the National Securities Market Commission in Spain (CNMV).

Bad Reviews

Complaints against BBbanc are everywhere on the Internet. Many of the victims told their stories, reminding other investors to stay away from the broker.