Provider of post trade services for the financial industry Euroclear today posted a set of solid metrics for the first half of 2021.

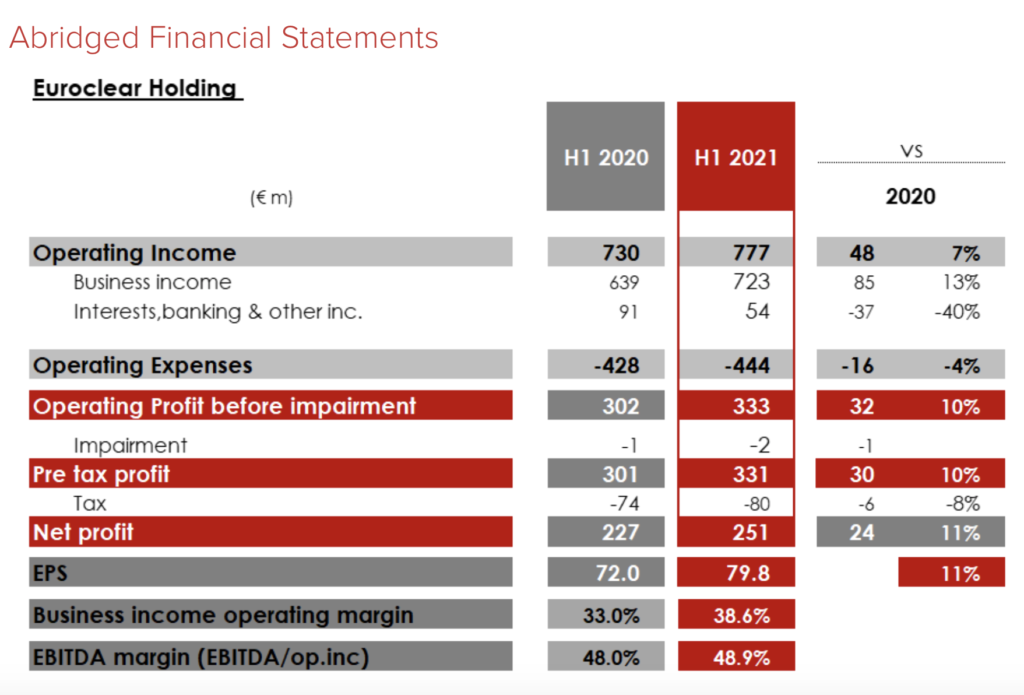

Operating income for the first six months of 2021 increased 7% to EUR 777 million (H1 2020: EUR 730 million). Business Income rose 13% to EUR 723 million, whereas Banking and Other Income decreased 40% to EUR 54 million (H1 2020: EUR 91) million) due to lower interest rates.

Operating costs were up 4% to EUR 444 million (H1 2020: EUR 428 million) as technology investments continued to enhance business resilience and the customer proposition.

Euroclear posted net profit of EUR 251 million in the first half off 2021, up 11% from EUR 227 million registered a year earlier.

EPS increased 11% to EUR 79.8 per share (H1 2020: EUR 72.0)

As previously announced, the Board intends to approve the dividend related to 2020 results for payment in September 2021. The dividend will be stable compared to the one of March.

Key operating metrics remained strong in the first half of 2021, as assets under custody reached EUR 35.2 trillion at the end June, marking an increase of 13% year-on-year. Euroclear also saw a record number of netted transactions settled in the Euroclear group of 149 million, an increase of 6% (H1 2020: 141 million).

Euroclear also reported continued progress of its strategic plans. The company is on track to close MFEX acquisition in second half of 2021, as planned.

Lieve Mostrey, Chief Executive Officer, commented:

“I am pleased to report that Euroclear achieved a record business performance in the first half of 2021. Our consistent strategy has delivered a growing financial performance, despite a business environment that remains uncertain.

By continuing to invest in our people and technology, we are supporting our clients’ and the broader market’s need for robust infrastructure, across asset classes, as they access our global network of financial market participants.”