When it comes to trading forex, choosing the right broker can be crucial to your success. With so many options available, it’s important to understand the different brokerage models and how they operate. One of the most commonly debated topics in the forex industry is whether dealing desk brokers are equivalent to market makers. In this article, we’ll take a closer look at both of these models and examine the key differences between them.

Dealing Desk Brokers

Dealing desk brokers, also known as market makers, are forex brokers that take the opposite side of their clients’ trades. In other words, when a client buys a currency pair, the dealing desk broker sells that same currency pair. Likewise, when a client sells a currency pair, the dealing desk broker buys that same currency pair. This means that the broker acts as the counterparty to all of their clients’ trades.

One of the main advantages of dealing desk brokers is that they can offer tighter spreads and faster trade execution. Since they are the ones taking the other side of the trade, they have control over the bid-ask spread and can offer more competitive pricing. Additionally, they can execute trades faster since they don’t have to route orders to a liquidity provider.

However, one of the biggest criticisms of dealing desk brokers is that they have a conflict of interest with their clients. Since they are the ones taking the opposite side of their clients’ trades, there is a risk that they could manipulate prices or execute trades in their own best interest, rather than their clients’. This is why many traders prefer to use non-dealing desk brokers, which we’ll discuss next.

Non-Dealing Desk Brokers

Non-dealing desk brokers, also known as ECN/STP brokers, are forex brokers that act as intermediaries between their clients and the market. When a client places a trade, the non-dealing desk broker sends that order to a liquidity provider, who then executes the trade. This means that the broker does not take the opposite side of their clients’ trades and has no conflict of interest.

One of the main advantages of non-dealing desk brokers is that they offer more transparency and fairness. Since they do not take the opposite side of their clients’ trades, there is no risk of price manipulation or unfair execution. Additionally, non-dealing desk brokers often offer more advanced trading platforms and tools, which can be beneficial for more experienced traders.

However, non-dealing desk brokers often have wider spreads and slower trade execution compared to dealing desk brokers. This is because they have to route orders to a liquidity provider, which can take time and result in higher spreads.

So, Are Dealing Desk Brokers Equivalent to Market Makers?

The term dealing desk brokers is often used interchangeably with market makers. However, this is not entirely true. Market makers are the parties that provide liquidity and quote both the buy and sell rates. They can be individuals, brokers, banks, hedge funds, and other financial firms. Large banks in particular are the master market makers.

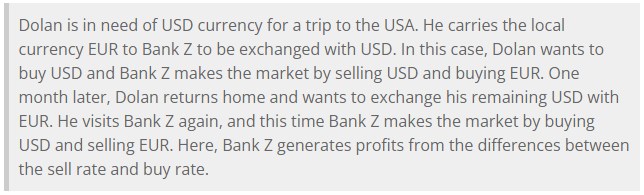

One simple example of the market-making practice is a foreign exchange transaction in a local bank. This is very similar to the business activity of market makers in forex trading. Let’s see the illustration below.

Judging brokers’ quality solely based on their type is not a sensible thing to do. So no matter what type of broker you’re about to register with, it’s highly recommended to research its track record and check the reviews first.