Citigroup Inc (NYSE:C) has just posted its financial report for the final quarter of 2021.

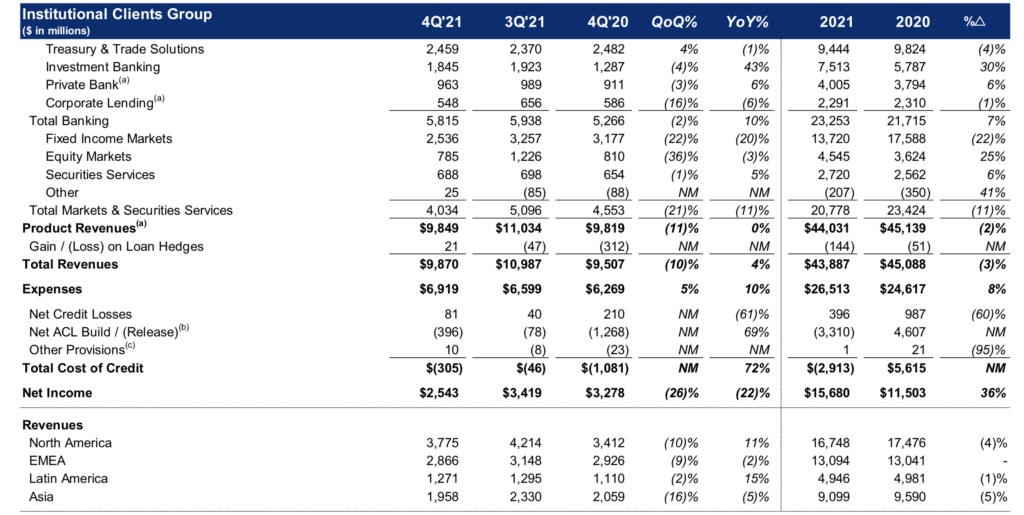

Citi reported Institutional Clients Group (ICG) revenues of $9.9 billion, up 4% from the same period in 2020, primarily driven by higher revenues in Investment Banking, the Private Bank and Securities Services, partially offset by a decline in Fixed Income Markets.

Markets and Securities Services revenues of $4.0 billion decreased 11% from the year-ago quarter. The result also lagged behind the $5 billion in revenues registered in the third quarter of 2021.

Fixed Income Markets revenues of $2.5 billion decreased 20%, as solid growth in FX and commodities was more than offset by a decline in rates and spread products. Equity Markets revenues of $785 million decreased 3%, as continued growth in prime finance balances and structured activities was offset by a decline in cash.

Securities Services revenues of $688 million increased 5% on a reported basis and 7% in constant dollars, driven by higher settlement volumes and higher assets under custody, partially offset by lower deposit spreads.

Across all segments, Citigroup reported net income for the fourth quarter 2021 of $3.2 billion, or $1.46 per diluted share, on revenues of $17.0 billion. This compared to net income of $4.3 billion, or $1.92 per diluted share, on revenues of $16.8 billion for the fourth quarter 2020.

Revenues increased 1% from the prior-year period, primarily driven by strong growth in Investment Banking in the Institutional Clients Group (ICG) and higher revenues in Corporate / Other, partially offset by lower revenues across regions in Global Consumer Banking (GCB).

Net income of $3.2 billion decreased 26% from the prior-year period, reflecting higher expenses, partially offset by higher revenues and lower cost of credit. Results for the quarter included a pre-tax impact of approximately $1.2 billion ($1.1 billion after taxes) related to the divestitures of Citi’s consumer banking businesses in Asia.

Earnings per share of $1.46 decreased 24% from the prior-year period. Excluding the impact of Asia divestitures, earnings per share of $1.99 increased 4%, primarily reflecting a 4% reduction in shares outstanding.

For the full year 2021, Citigroup reported net income of $22.0 billion on revenues of $71.9 billion, compared to net income of $11.0 billion on revenues of $75.5 billion for the full year 2020.

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

I am currently writing a paper and a bug appeared in the paper. I found what I wanted from your article. Thank you very much. Your article gave me a lot of inspiration. But hope you can explain your point in more detail because I have some questions, thank you. 20bet

Jeśli Twój mąż usunął historię czatów, możesz także skorzystać z narzędzi do odzyskiwania danych, aby odzyskać usunięte wiadomości. Oto kilka powszechnie używanych narzędzi do odzyskiwania danych: https://www.xtmove.com/pl/how-do-i-see-text-messages-from-my-husband-on-my-phone/

Hello friends, its enormous paragraph regarding teachingand fully

explained, keep it up all the time.

The fate of the kingdom rests in your hands! Lucky cola

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

10 Healthy Fridge Freezer On Sale Habits fridge Freezers near me

10 Healthy Habits For A Healthy Anxiety Disorder Physical Symptoms anxiety Symptoms

The Unspoken Secrets Of Lidar Navigation Best Robot Vacuum Lidar

You’ll Never Guess This Walking Aid Rollator’s Benefits walking Aid rollator (http://Www.lp91.com)

This Is The Advanced Guide To Bentley Continental Key

Programming bentley smart key (zakupis-ekb.ru)

10 Apps That Can Help You Manage Your Assessment Of Adult Adhd

Adhd Assessment For Women

3 Ways That The Lexus Key Fob Will Influence

Your Life Who Can Cut A Lexus Key

5 Killer Quora Questions On Repair Patio Door Lock patio glass repair

Looking Into The Future How Will The Montpellier Retro Fridge Freezer Industry Look Like

In 10 Years? retro looking fridge freezer (Ashleigh)

Car Key Tools To Make Your Life Everyday Peugeot 207 key

15 Gifts For The Pull Out Sofa Couch Lover

In Your Life pull out sleeper

Fireplace Bioethanol Tools To Ease Your Daily Life Fireplace Bioethanol Trick That

Should Be Used By Everyone Be Able To Fireplace Bioethanol

10 Apps That Can Help You Control Your Lightweight Folding Travel Mobility Scooters

Folding Lightweight Mobility Scooter

The Pluses And Minuses Of Mobile Massage 해운대오피

(https://www.chemie24.nl/delete-company-details?element=http://yerliakor.com/user/benchart1/)

Plates And Napkins – Using Your Tableware As Party Favors 남구오피 (http://www.google.kz)

10 Basics On Small Wood Stove You Didn’t Learn In School 5829186.xyz, Lashunda,

The 3 Biggest Disasters In Black Chest Freezer History where can i buy a freezer chest

The 10 Scariest Things About Pushchairs Pushchairs pushchairs Pushchairs

10 Real Reasons People Hate Depression Treatment Guidelines best medication To Treat Anxiety and depression

What NOT To Do During The Audi A3 Key Battery Industry remote

Guide To Mesothelioma Lawsuit: The Intermediate Guide Towards Mesothelioma Lawsuit mesothelioma (suhl.Com)

15 Terms That Everyone Is In The Situs Toto Togel Industry Should Know bandar toto (https://www.1110wang.com/zb_users/theme/jackso/template/go.Php?url=globalimport.spb.ru/go/url=https://akbidsarimulia.ac.id/asp/)

Solutions To The Problems Of Electric Wall Fireplace wall hanging fire

Coffee Bean Shop’s History History Of Coffee Bean Shop gourmet coffee

beans [Monica]

Why Nobody Cares About Mesothelioma Legal mesothelioma attorney – Sherry,

10 Healthy Volvo Key Habits Volvo Small Key Fob

What’s The Current Job Market For Adhd Assessment In Adults

Professionals? Adhd assessments for Adults

5 Killer Quora Answers To Near Me Psychiatrist Near Me psychiatrist

How To Find The Perfect Sectional With Storage And Pull Out On The Internet l shaped sectional couch with pull out bed

Guide To Radiators Oil Filled: The Intermediate Guide For Radiators Oil Filled

radiators oil filled

The 3 Biggest Disasters In Bromley Windows And Doors The

Bromley Windows And Doors’s 3 Biggest Disasters In History Sash Windows Bromley (Emsworthsc.Org.Uk)

Three Greatest Moments In Rolls Royce Keys History rolls-royce keys

Its History Of 3 Wheel Double Buggy 435871

Are Situs Alternatif Borneoslot Just As Important As Everyone

Says? http://www.287682.Xyz

Party Favor Ideas For Inexpensive Giving Gifts 대구마사지

10 Things We All Hate About Contemporary Multi Fuel Stoves Multifuel stoves

See What Titration ADHD Adults Tricks The Celebs Are Making Use Of titration adhd adults (https://www.google.co.cr)

15 Gifts For The Vibrating Anal Sex Toys Lover In Your Life anal sexual Toys

Learn More About Private ADHD Diagnosis UK When You Work

From At Home private adhd assessment oxford – Keisha,

20 Myths About Automatic Fleshlight: Busted Male Masterbation Sleeve

Private Psychiatrist In London: What No One Has Discussed Private Psychiatrist Leicester Cost

What Add Women Experts Want You To Learn add test for women – Epifania –

5 Panty Vibrators Sex Toys Projects That Work For Any Budget remote

vibrator in public (Wilbert)

Where To Meet Women Without Going To Bars And Clubs 강북오피 (211.45.131.204)

Five Mesothelioma Attorney Projects For Any Budget Mesothelioma Case

[https://Helpf.Pro]

You’ll Never Guess This Kimbo Extra Cream Coffee Beans 1kg’s Benefits Beans 1kg

5 Motives Leather Sectional Sofa Is Actually A Great Thing sectional sofa sale [Rosario]

How The 10 Most Disastrous 3 Piece Sectional Sofa Failures Of

All Time Could Have Been Prevented sectional sofas Sleeper Sofas

The 10 Most Scariest Things About Patio Door Lock Repairs

Near Me patio door lock repairs near me

Here’s A Little Known Fact About Cheap Leather Couches.

Cheap Leather Couches Leather sofas for sale

16 Must-Follow Pages On Facebook For Porsche Key Fobs Marketers porsche cayman key (Bruno)

Why Buy A Fleshlight Is Tougher Than You Imagine best fleshlights (Marcela)

What’s The Current Job Market For Daftar Situs Togel Professionals Like?

Daftar Situs Togel

The 3 Greatest Moments In Accidents Lawyer History attorney accident lawyer (Brooks)

11 Ways To Totally Defy Your Nissan Key Replacement Prices nissan Key Cutting

A New Trend In Keys Mercedes mercedes benz Key

10 Amazing Graphics About Lost Keys To Car No Spare http://www.99811760.xyz

The Leading Reasons Why People Achieve In The Curved Leather Sofa Industry faux Leather sofa

20 Things Only The Most Devoted Sleeper Couch Fans Understand Leather Sleeper Couch

For Whom Is Renault Kangoo Spare Key And Why You Should Consider Renault Kangoo

Spare Key renault megane key card repair (Otilia)

15 Gifts For The Mesothelioma Claim Lover In Your Life mesothelioma law firms (http://www.Google.se)

14 Smart Ways To Spend Extra Money Kia Replacement Key Fob Budget Kia picanto Car key Replacement

10 Things You Learned In Kindergarden That’ll Help You With Car

Trunk Lock Repair damaged car lock (Doug)

An Easy-To-Follow Guide To Private ADHD Assessment

London Private adhd assessment Edinburgh cost

Why Everyone Is Talking About Private Psychiatrist Online Right Now private psychiatry London

5 Killer Quora Answers On Pushchair Buggy Pushchair Buggy

Check Out: How Realistic Masturbators For Men Is Gaining Ground And What We Can Do About It Realisticsex Doll

10 Signs To Watch For To Get A New Leather Couch the leather Sofa company

How You Can Use A Weekly Butt Plug Project Can Change Your

Life Sex With Butt Plug – https://Www.Xcelenergy.Com

–

Party Stuffs Or Party Decorations: Plan Your Requirements First 대덕구오피; http://golubcapitalre.com,

Guide To Bed And Couch: The Intermediate Guide To Bed And Couch bed and couch

“Ask Me Anything:10 Responses To Your Questions About Best Car Seat Newborn car seat for newborn; Karina,

10 Inspirational Graphics About Male Masterbation Toy Male masterbation Toys

The Unspoken Secrets Of Small Single Stroller lightweight single stroller

The Only Guide You Need To Give Issue Massage Of All Time

대전오피 (https://www.darkelf.sk)

A Look At The Future How Will The Wood Burning Stoves Industry

Look Like In 10 Years? 913875 – brokengenius.daa.jp,

10 Things That Your Family Taught You About Most Popular Adult Toys Most popular adult toys

How Ford Key Fob Was The Most Talked About Trend Of 2022 spare ford key (uastar.Net)

What’s The Reason? Foldable Treadmill Electric Is Everywhere This Year

treadmill Portable electric

The Ultimate Guide To Best Couples Toys Sexy toys for couples

The 10 Most Terrifying Things About Birth Injury Attorney

Kansas City birth injury attorney kansas city (the-Good.kr)

The 10 Scariest Things About Injury Accident Lawyers injury Accident lawyers

5 Killer Quora Answers On Best Sex Toys For Women Uk

Best Sex Toys For Women Uk (Nrns-Games.Com)

5 Characteristics To Identify When Evaluating A

Happy Hour 부평오피 (http://www.innotooth.co.kr/bbs/board.php?bo_table=free&wr_id=54724)

Sex Doll Realistic Techniques To Simplify Your Daily Lifethe

One Sex Doll Realistic Technique Every Person Needs To Be Able To sex doll realistic;

Randal,

Why Is Everyone Talking About Citroen Key Replacement Right Now lost Citroen Car Keys

What Is Ford Fiesta Replacement Key Cost Uk And Why Is Everyone Talking About It?

Program Ford Key, Gnuboard5.Gnuok.Com,

What NOT To Do In The Fireplace Industry Wall Fires

A Step-By-Step Guide To Selecting Your Mesothelioma Claim mesothelioma litigation (Marsha)

You’ll Never Guess This Bifold Door Roller Replacement’s

Secrets bifold Door roller replacement

The Little-Known Benefits Of ADHD Test Private adhd Test

9 . What Your Parents Taught You About Santa Fe Birth Injury Attorney santa fe birth injury attorney (http://www.Brakecaliper.co.Kr)

The 10 Most Terrifying Things About Bi Folding Door Repair

bi folding door repair (http://www.car-friends.co.kr)

Why Do So Many People Want To Know About Robot Vacuum Self

Emptying? Best bagless self Emptying robot vacuum

The Advanced Guide To Walking Pad For Standing Desk walking pad for

under desk – Pantalassicoembalagens.com.br –

15 Best Robot Self Emptying Vacuum Bloggers You Need To Follow

best robot Self emptying vacuum

You’ll Never Guess This Bagless Robot Vacuum Cleaner’s Tricks bagless Robot vacuum cleaner

The One Inexpensive Electric Treadmills Mistake That Every

Beginning Inexpensive Electric Treadmills User Makes motorized Electric treadmill

20 Reasons To Believe Nissan Qashqai Key Will Not

Be Forgotten nissan Juke key fob programming

The 3 Most Significant Disasters In Seat Replacement Key The Seat Replacement Key’s 3 Biggest Disasters In History seat leon key – Trina,

See What Bifold Repairs Near Me Tricks The Celebs Are Using bifold repairs near me (9d0br01aqnsdfay3c.kr)

Your Family Will Thank You For Getting This Ford Fiesta Replacement Key Cost Uk replacement Key For ford Kuga

A Proficient Rant Concerning 2 In 1 Travel System egg stroller 2 In 1

20 Myths About Double Bunk Beds Top And Bottom: Busted bunk Bed with pull out double bed

Mini Car Key Cover Isn’t As Difficult As You Think mini cooper keys not working

The Top Motorised Treadmills Gurus Are Doing

Three Things electric treadmill with auto incline

What’s The Current Job Market For Bi Fold Door Repairs Professionals Like?

bi fold door repairs (Jerrell)

8 Tips For Boosting Your Audi Key Replacement Game Audi New Key

Why Mesothelioma Lawyer Is Right For You? mesothelioma case (https://saerodental.com/bbs/board.php?bo_table=free&wr_id=949825)

The Reason Why You’re Not Succeeding At Audi Q7 Car Key Replacement Audi car keys

The 10 Scariest Things About Mesothelioma Lawyer mesothelioma Lawyer

You’ll Never Guess This Treadmill Folded Up’s Tricks treadmill folded up

The 10 Most Popular Pinterest Profiles To Keep Track Of Diagnosing ADHD adhd Diagnosis cost Uk

Five Killer Quora Answers To Fold Away Treadmill UK fold Away treadmill Uk

What’s The Job Market For Bagless Wifi-Connected Robot Professionals

Like? bagless wifi-connected robot (Lakeisha)

5 Killer Quora Answers To Bi Folding Door Repair Near Me

Bi Folding Door Repair Near Me

A Peek At The Secrets Of Upvc Windows High Wycombe window replacement high Wycombe

You’ll Never Be Able To Figure Out This Treadmills UK’s Benefits treadmills uk (Astrid)

10 Things Everyone Hates About Foldaway Treadmill With Incline Foldaway Treadmill With Incline treadmill with incline for

small Spaces (https://altlifewiki.com/index.php/You_ll_Never_Guess_This_Is_Treadmill_Incline_Good_s_Tricks)

5 Tools That Everyone Within The 3 Wheel Running Stroller Industry Should Be Utilizing 435871

10 Tips To Know About Jaguar Xf Key Cover jaguar car keys

West Elm Pull Out Couch Tools To Ease Your Daily Life West Elm Pull Out Couch Trick That

Everybody Should Be Able To Pull Out Couch

Nine Things That Your Parent Taught You About Self Emptying

Robot Vacuums Self emptying Robot vacuums

Who’s The Top Expert In The World On White Fridge Freezer With Water

Dispenser? fridge freezer ice and Water

Why Sectional Sleeper Sofa Should Be Your Next Big

Obsession small sectional sleeper sofa

The Most Effective Reasons For People To Succeed With The Citroen C1 Car Key Replacement Industry citroen C5 aircross key

What’s The Current Job Market For Floor Vacuum Robot Professionals

Like? Floor Vacuum Robot

Guide To Cream Electric Stove Fire: The Intermediate Guide Towards Cream Electric Stove Fire Cream electric stove

9 . What Your Parents Taught You About Treadmill At

Home treadmill

The 10 Most Terrifying Things About L Shaped Leather Settee l shaped Leather settee (http://www.jinguii.com)

Seat Keys Replacement Tools To Streamline Your Everyday

Lifethe Only Seat Keys Replacement Trick Every Individual Should

Know seat keys Replacement

Robot Vacuum Cleaner With Lidar Explained In Fewer Than 140 Characters lidar explained

(http://www.pssolhyang.com)

It’s The Complete Cheat Sheet On Mesothelioma Legal Mesothelioma Lawsuit (Mukgonose.Exp.Jp)

Five Peugeot 207 Key Lessons From The Pros Peugeot 107 Remote Key

10 Reasons Why People Hate Patio Door Repairs Near Me.

Patio Door Repairs Near Me Upvc patio door repairs near me

10 Misconceptions That Your Boss May Have Regarding Robot Vacuums For Pet

Hair affordable robot Vacuum – https://kazellwuu.mycafe24.com/ –

10 Lamborghini Huracan Key-Related Meetups You Should Attend lamborghini key fob

Five Patio Glass Door Repair Near Me Lessons From The Pros Sliding Patio Door Repair Service Near Me

15 Things You’re Not Sure Of About Private ADHD Assessment

Glasgow private Adhd assessment gloucestershire

The Often Unknown Benefits Of Small Sectional Sofa With Recliner Reclining Sectional Sofa

15 Reasons Why You Shouldn’t Ignore Titrating

Medication What Is Titration In Adhd

Why All The Fuss About Symptoms Of Depression With Anxiety?

Mental Health Symptoms

20 Trailblazers Setting The Standard In Mercedes Ignition Key replacement mercedes key fob (Jonas)

The Most Effective Reasons For People To Succeed In The Mesothelioma

Law Industry mesothelioma legal (Katherin)

10 Tips For Double Glazing Cambridge That Are Unexpected Door seal Repair Near Me

What Is Treatments For Anxiety Disorders And How To Utilize

What Is Treatments For Anxiety Disorders And How To Use

natural treatment for anxiety attacks (http://www.brakecaliper.co.kr/)

You’ll Never Guess This Replacement Ford Fiesta Key Uk’s Tricks Ford Replacement Car Keys

15 Things Your Boss Wished You Knew About Mesothelioma Litigation Mesothelioma Attorneys

15 Pinterest Boards That Are The Best Of All Time About Bromley Window Repair Window Fitter Bromley

(Gbpl.Kr)

What Are The Myths And Facts Behind Nissan Juke Spare Key nissan navara key system fault

Are You Responsible For The Diagnosis For ADHD

Budget? 10 Terrible Ways To Spend Your Money bupa adhd

diagnosis (Della)

Are You Getting The Most The Use Of Your Bmw Key? Lost Bmw Key

10 Places Where You Can Find Adult Adhd Assessment Uk adhd assessment for adults

How To Make Sure Your Atm Business Profits 하이오피 커뮤니티 (stevelukather.com)

The Reasons Mesothelioma Law Is More Difficult Than You Think Mesothelioma Lawyers

10 No-Fuss Ways To Figuring Out The Private ADHD Assessment Wales In Your Body.

Private Adult Adhd Assessment

What Is Milton Keynes Door And Window And How To Use What Is Milton Keynes

Door And Window And How To Use aluminium doors

milton keynes (http://xilubbs.xclub.tw/space.php?uid=1906625&do=profile)

10 Misconceptions That Your Boss May Have About Door Fitters

Maidstone Door Fitters Maidstone Misted double glazing maidstone

10 ADHD Adults Test Tips All Experts Recommend adhd testing online, Jacquelyn,

15 Things You’ve Never Known About Mercedes Keys mercedes key replacement (Odell)

A Look In Depression And Symptoms’s Secrets Of Depression And Symptoms behavioral symptoms of depression (Lonnie)

The Three Greatest Moments In Adhd Assessment In Adults History adult Adhd assessment London

15 Weird Hobbies That Will Make You Better At Private Psychiatrist Near Me Psychiatrists

The Top Mesothelioma Legal Question Gurus Are Doing Three Things mesothelioma lawyers

10 Unexpected Fiat 500 Key Cover Tips fiat keys replacement

5 Killer Quora Answers To Mesothelioma Law Firm mesothelioma

See What Key Of Rolls Royce Tricks The Celebs Are Utilizing key of rolls royce

10 Volvo Xc60 Replacement Key Cost Tricks All Experts

Recommend Volvo Xc90 Keys

The Secret Life Of Ferrari Replacement Key Cost Uk How Much To Replace A Ferrari Key

20 Reasons Why Doctor Window Will Not Be Forgotten window Hinge Repair

14 Questions You Might Be Afraid To Ask About Double Glazing Suppliers

Near Me replacement double glazing

Are You Responsible For A Mini Key Fobs Budget? 10 Incredible Ways To Spend Your Money i lost my mini Cooper key

10 Top Books On Mesothelioma Settlement Mesothelioma Lawyers

10 Facebook Pages That Are The Best Of All Time Mesothelioma Lawyer mesothelioma litigation – studioredbricks.Com,

20 Up-And-Comers To Watch In The Jaguar Xf Key Industry jaguar x

type key fob programming (Aracelis)

9 . What Your Parents Teach You About Smart Car Key Fob smart car key fob

Excellent, what a web site it is! This webpage provides helpful information to

us, keep it up.

I love your blog.. very nice colors & theme. Did you design this website yourself or did you hire someone to do it for you?

Plz answer back as I’m looking to construct my own blog and

would like to find out where u got this from.

thanks

New York City Clubs Ultimate Guide Revealed! 연산오피

How To Post Women – 5 Tips HIOP (http://girlsservingpeople.com/)

menang33

When some one searches for his required thing, so he/she needs to be

available that in detail, so that thing is maintained

over here.

kijangwin kijangwin kijangwin kijangwin kijangwin

Awesome! Its actually awesome piece of writing, I have

got much clear idea regarding from this piece of writing.

chord gitar st12 – rasa yang tertinggal

After I initially commented I appear to have clicked the -Notify me when new comments are

added- checkbox and now whenever a comment is added I recieve four emails

with the same comment. Is there a means you can remove me from that service?

Cheers!

latoto latoto latoto latoto

I always spent my half an hour to read this website’s articles all the time along with a cup

of coffee.

slot gacor hari ini slot gacor hari ini slot gacor hari ini slot gacor hari ini

all the time i used to read smaller articles or reviews that

also clear their motive, and that is also happening with this piece of writing which I am reading here.

anichin vip

Currently it seems like WordPress is the best blogging platform out there right

now. (from what I’ve read) Is that what you’re using on your blog?

pragmatik play pragmatik play pragmatik play

Yes! Finally someone writes about live draw

hk.

chord resah jadi luka

Good post. I learn something totally new and challenging on sites I stumbleupon everyday.

It will always be useful to read content from other writers and practice something

from other sites.

boba55

You have made some decent points there. I checked on the web for more info about the issue

and found most individuals will go along with your views on this web site.

Good site you have got here.. It’s hard to find excellent writing like yours these days.

I seriously appreciate individuals like you! Take care!!

Hi there every one, here every one is sharing these

familiarity, thus it’s nice to read this web site, and I used to pay a quick visit this weblog

daily.

Greetings! Very useful advice in this particular article!

It is the little changes that produce the greatest changes.

Thanks for sharing!

Amazing issues here. I’m very glad to look your

post. Thanks a lot and I am having a look forward to

contact you. Will you kindly drop me a mail?

Hi would you mind letting me know which webhost you’re working

with? I’ve loaded your blog in 3 completely different browsers and I must say this blog loads

a lot faster then most. Can you suggest a good hosting provider at

a honest price? Thanks, I appreciate it!

The best adventures happen online Lodibet

Saved as a favorite, I like your blog!

I love your blog.. very nice colors & theme. Did you

create this website yourself or did you hire someone to do it for you?

Plz respond as I’m looking to create my own blog and would

like to find out where u got this from. thanks

Greetings! I know this is somewhat off topic but I was wondering if you knew where I could find

a captcha plugin for my comment form? I’m using the same blog platform as yours and I’m

having trouble finding one? Thanks a lot!

Thanks in favor of sharing such a nice idea, piece of writing is fastidious,

thats why i have read it completely

Hmm is anyone else having problems with the

pictures on this blog loading? I’m trying to figure out if its

a problem on my end or if it’s the blog. Any feed-back would be greatly appreciated.

Excellent post. Keep posting such kind of info on your site.

Im really impressed by your blog.

Hello there, You have done a great job. I will certainly

digg it and in my view suggest to my friends. I’m confident they will be benefited from this website.

Greetings from Carolina! I’m bored at work so I decided to browse your blog on my iphone during lunch break.

I enjoy the information you provide here and can’t wait to take a look when I get home.

I’m surprised at how fast your blog loaded on my phone ..

I’m not even using WIFI, just 3G .. Anyhow, great site!

My programmer is trying to persuade me to move

to .net from PHP. I have always disliked the idea because of the

expenses. But he’s tryiong none the less. I’ve been using WordPress on numerous websites

for about a year and am concerned about switching to another platform.

I have heard great things about blogengine.net.

Is there a way I can import all my wordpress content into it?

Any help would be greatly appreciated!

Hmm is anyone else encountering problems with the images on this

blog loading? I’m trying to determine if its a problem on my end or if it’s the blog.

Any feed-back would be greatly appreciated.

Good post. I learn something totally new and challenging on blogs I stumbleupon every day.

It’s always helpful to read through content from other writers and practice

something from other sites.

I’m impressed, I must say. Seldom do I come across a blog that’s

both educative and engaging, and let me tell you, you’ve hit

the nail on the head. The issue is something too few people are speaking intelligently about.

I am very happy that I found this during my hunt for something relating to this.

Howdy, i read your blog from time to time and i own a similar one and i was just wondering if you get a lot of spam remarks?

If so how do you reduce it, any plugin or anything

you can recommend? I get so much lately it’s driving me insane so any support is very much

appreciated.

Superb site you have here but I was curious about if you knew of any forums that cover the same topics

talked about in this article? I’d really love to be a

part of group where I can get responses from other knowledgeable individuals that share the same interest.

If you have any recommendations, please let me know.

Many thanks!

Hi, i think that i noticed you visited my weblog thus i came to return the favor?.I am attempting to in finding issues to enhance my website!I guess its ok to make use of a few of your ideas!!

Please let me know if you’re looking for a author for your site.

You have some really great articles and I think I would be a good asset.

If you ever want to take some of the load off, I’d absolutely love to write some material for

your blog in exchange for a link back to

mine. Please shoot me an email if interested. Thank you!

This is a very good tip particularly to those new to the blogosphere.

Brief but very precise info… Thanks for sharing this one.

A must read post!

Unquestionably believe that that you said. Your favourite reason seemed to be on the internet the simplest thing to bear in mind of.

I say to you, I definitely get irked whilst other folks think about

worries that they plainly do not understand about. You controlled to hit the nail upon the highest and also outlined out the entire thing without having side effect , other folks can take a signal.

Will likely be back to get more. Thanks

The other day, while I was at work, my sister stole my apple ipad and tested to see if it can survive a 25 foot drop,

just so she can be a youtube sensation. My iPad is now broken and she has 83

views. I know this is totally off topic but

I had to share it with someone!

https://binomo.as

Aw, this was an exceptionally good post. Spending some time and actual effort to create a great

article… but what can I say… I put things off

a lot and never seem to get anything done.

Fastidious answers in return of this issue with

genuine arguments and telling the whole thing concerning that.

I am truly delighted to glance at this web site posts which consists of plenty of helpful information, thanks for providing these data.

Thank you for the good writeup. It in fact was a amusement account it.

Look advanced to more added agreeable from you! However, how could we communicate?

Its like you read my mind! You seem to know a lot about this,

like you wrote the book in it or something. I think that you could do with a few pics to drive the message home a bit,

but other than that, this is magnificent blog. An excellent read.

I will certainly be back.

Howdy! Someone in my Myspace group shared this site with us so I

came to look it over. I’m definitely enjoying the information.

I’m book-marking and will be tweeting this to my followers!

Outstanding blog and amazing style and design.

Greetings from Idaho! I’m bored to death at work so I decided to check

out your website on my iphone during lunch break.

I love the knowledge you present here and can’t

wait to take a look when I get home. I’m shocked at how quick

your blog loaded on my phone .. I’m not even using WIFI, just 3G

.. Anyways, very good site!

I was wondering if you ever considered changing the page

layout of your site? Its very well written; I love what youve got to

say. But maybe you could a little more in the way of content so people could

connect with it better. Youve got an awful lot of text for only having

one or 2 images. Maybe you could space it out better?

Good day! Do you know if they make any plugins to protect against hackers?

I’m kinda paranoid about losing everything I’ve worked hard on. Any recommendations?

Awesome! Its actually awesome paragraph, I have got much clear idea about from this post.

index

I don’t know if it’s just me or if perhaps everybody else encountering issues with your site.

It seems like some of the text on your content are running off the screen. Can somebody else please provide feedback and let me know if this is happening to them too?

This could be a issue with my browser because I’ve had this happen before.

Thank you

Do you have a spam issue on this site; I also am a blogger, and I was wondering your situation;

we have created some nice procedures and we are looking to swap solutions with

other folks, be sure to shoot me an email if interested.

Appreciate this post. Will try it out.