In the world, gold and crude oil are the two most traded commodities in the foreign exchange market. Due to its high volatility, trading gold and crude oil alone and seizing good opportunities can obtain good returns, but in fact, the combination of the two can produce better results.

The price of crude oil is quoted in US currency and movement in the dollar or in the oil price generates an immediate impact on the related currencies. These movements are strongly correlated in economies that have significant reserves (Russia, Canada and Brazil) while less correlation is observed for economies with more diverse resources (Japan).

The relationship between gold and crude oil

Both gold and crude oil are denominated in U.S. dollars, so they are closely related to the U.S. dollar.

Because of its safe-haven and value-storage characteristics, gold can completely replace the U.S. dollar in an economic downturn, so gold and the U.S. dollar are negatively correlated. Crude oil and the U.S. dollar also show a negative correlation. Therefore, gold and crude oil have a certain positive correlation to some extent.

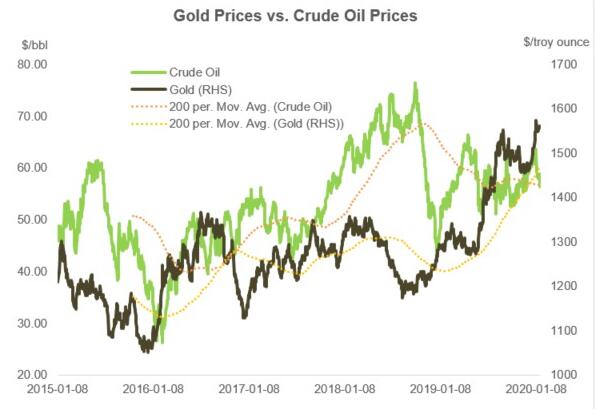

It has been calculated that the correlation coefficient between gold and US dollar is -0.428, the correlation coefficient between US dollar and crude oil is -0.610, and the correlation coefficient between gold and crude oil is 0.788, which also shows that there is a certain positive correlation between gold and crude oil prices.

The price relationship between gold and crude oil is mainly related to inflation. It is said that the price of crude oil is a “barometer” of the global economy, and gold is an effective tool to curb inflation. When the price of crude oil rises, it will cause inflation to heat up, so interest rates will be lowered, and the expected economic downturn will cause the price of gold to rise. However, there is a time difference between the price changes of the two, and they do not rise or fall simultaneously.

In addition, the relationship between crude oil and gold can also be explained from the perspective of mining costs. A rise in crude oil prices will increase mining costs, so it is necessary to increase the price of gold.

Gold and Crude Oil Trading

Gold is both a metal and a currency. Its main features are value preservation and easy storage. It is an effective tool for value storage. Petroleum is an energy commodity, known as “black gold”, and its storage cost is relatively high, so oil is a consumption-type investment product with low storage value.

The above characteristics establish the characteristics of gold and crude oil trading. When the economy is uncertain or encounters a major economic crisis, gold is a safe investment object for investors and a safe haven for traders. The demand for crude oil will grow with the growth of the economy, because it is an important energy source for industrial production and transportation of goods.

Investing in gold helps to offset the uncertain risks of the market, and investing in crude oil is based on market trends. Combining the two, you can hedge against each other.

But note that gold prices can lead changes in market sentiment, while crude oil prices follow economic growth. That is to say, if the market expectations are better, investors will sell gold, and only after the actual economic growth, investors will buy crude oil.

There is a positive correlation between gold and crude oil prices, so whether you invest in gold or crude oil, you can pay attention to the fundamental news of the two. Generally, when gold is good, it is also good for crude oil. Crude oil is an important predictor of the trend of gold, and the nature of the price of crude oil changing with the economy mainly depends on the relationship between global crude oil supply and demand.

When judging the price trend of gold and crude oil, the ratio of the two is also used, that is, the gold-oil ratio. It is generally believed that the gold-oil ratio will return to historical levels, making the price of gold and crude oil move in the same direction.