Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has posted its financial performance metrics for the second quarter of 2021.

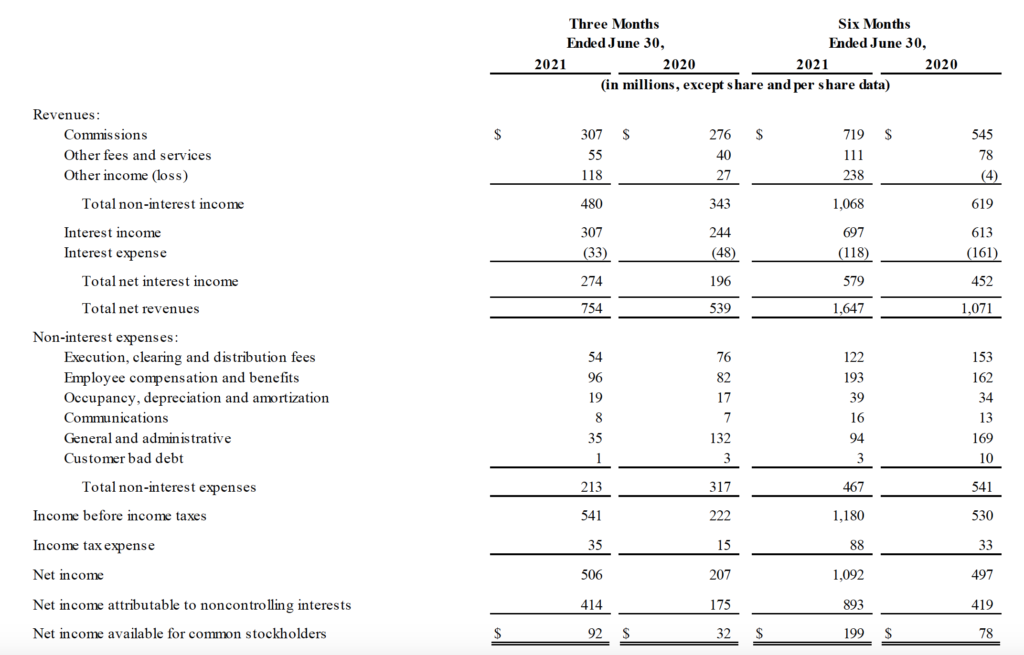

Net revenues for the second quarter of 2021 were $754 million, up from net revenues of $539 million in the equivalent period a year earlier. The result, however, lagged behind the one registered in the first quarter of 2021.

Income before income taxes was $541 million in the April-June 2021 period, compared to income before income taxes of $222 million for the same period in 2020.

Adjusted net revenues were $650 million and adjusted income before income taxes was $437 million for this quarter, compared to adjusted net revenues of $523 million and adjusted income before income taxes of $310 million for the same period in 2020.

During the second quarter of 2021, commission revenue increased $31 million, or 11%, from the year-ago quarter on the back of higher customer stock and options trading volumes within an active trading environment.

Net interest income increased $78 million, or 40%, from the year-ago quarter on higher margin loan balances and strong securities lending activity.

Other income increased $91 million from the year-ago quarter. This increase was mainly comprised of:

-

$99 million related to Interactive Brokers’ strategic investment in Up Fintech Holding Limited (“Tiger Brokers”), which increased to a $113 million mark-to-market gain this quarter from a $14 million mark-to-market gain in the same period in 2020; and

-

$13 million related to Interactive Brokers’ U.S. government securities portfolio, which lost $0.2 million this quarter compared to a $13 million loss in the same period in 2020; partially offset by

- $25 million related to Interactive Brokers’ currency diversification strategy, which lost $9 million this quarter compared to a gain of $16 million in the same period in 2020.

General and administrative expenses decreased $97 million from the year-ago quarter, primarily due to the non-recurrence of $103 million in expenses incurred to compensate certain affected customers in connection with their losses on West Texas Intermediate Crude Oil contracts in April 2020.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.10 per share. This dividend is payable on September 14, 2021 to shareholders of record as of September 1, 2021.