A former Premier League star maintained his footballer’s lifestyle by scamming friends, family members and associates out of £15m, a court has heard.

The former Charlton Athletic defender Richard Rufus, 47, allegedly claimed to be a successful foreign exchange trader to convince his alleged victims to invest. But Rufus, who offered returns of 60 per cent a year from the “low-risk” scheme, lost money “hand over fist,” prosecutor Lucy Organ told Southwark Crown Court on Tuesday.

Rufus, from Crystal Palace, south-east London, denies three counts of fraud, using around £2m in criminal property and carrying out a regulated activity without authorisation, between May 2007 and April 2012. Ms Organ said that Rufus used some of the total £15m invested to pay back investors in a pyramid scheme, while some of the money was used for his own purposes.

He appeared “able to maintain a lifestyle of a footballer” long after he was forced into retirement in 2004 because of a knee injury, the court heard.

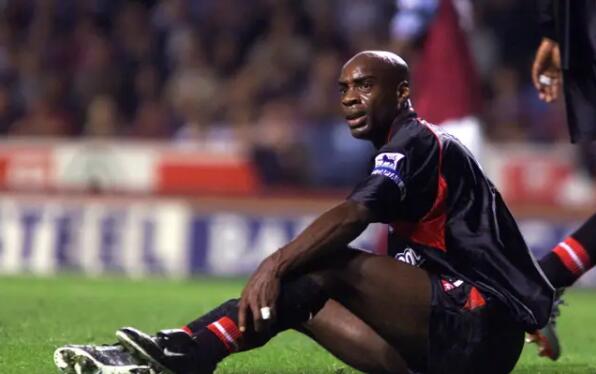

Richard Rufus in action for Charlton in 2001.

Rufus, who made 288 appearances for Charlton after joining the club in 1993, enjoyed the “trappings of wealth,”, living in a big five-bedroom house on a private estate in Purley, south London, driving a Bentley and wearing a Rolex watch, Ms Organ said. He was said to have remained on good terms with Charlton following his retirement, being invited to become an ambassador for a charity linked to the club, and was a committed member and trustee of a church, the Kingsway International Christian Centre.

Following his football career, he became involved in property investment before investing in the foreign exchange market. But Ms Organ said Rufus made “huge losses”, while around £2 million put into his personal accounts for the purposes of investment were never even transferred to his trading account.

“He scammed friends, family and associates out of millions of pounds by pretending he was able to offer a low-risk investment in the Foreign Exchange Market,” Ms Organ said. “He claimed that he had had significant success with his strategy in the past. In reality, the investments were fraught with risk. He lost their money, hand over fist.

“The investors, rather than getting the risk-free returns they were promised, lost a great deal of money. Mr Rufus took over £15m pounds in total.” Described as “charismatic and energetic”, Rufus claimed to have a track record of being a successful foreign exchange or foreign currency trader to persuade investors parting with their money was a safe and low-risk bet, the court heard.