Electronic trading major Interactive Brokers Group, Inc. (NASDAQ:IBKR) has just posted its financial results for the third quarter of 2021, with revenues and profits markedly down from the year-ago period.

The broker reported diluted earnings per share of $0.43 for the quarter ended September 30, 2021 compared to $0.58 for the equivalent period in 2020, and adjusted diluted earnings per share of $0.78 for this quarter compared to $0.53 for the year-ago quarter.

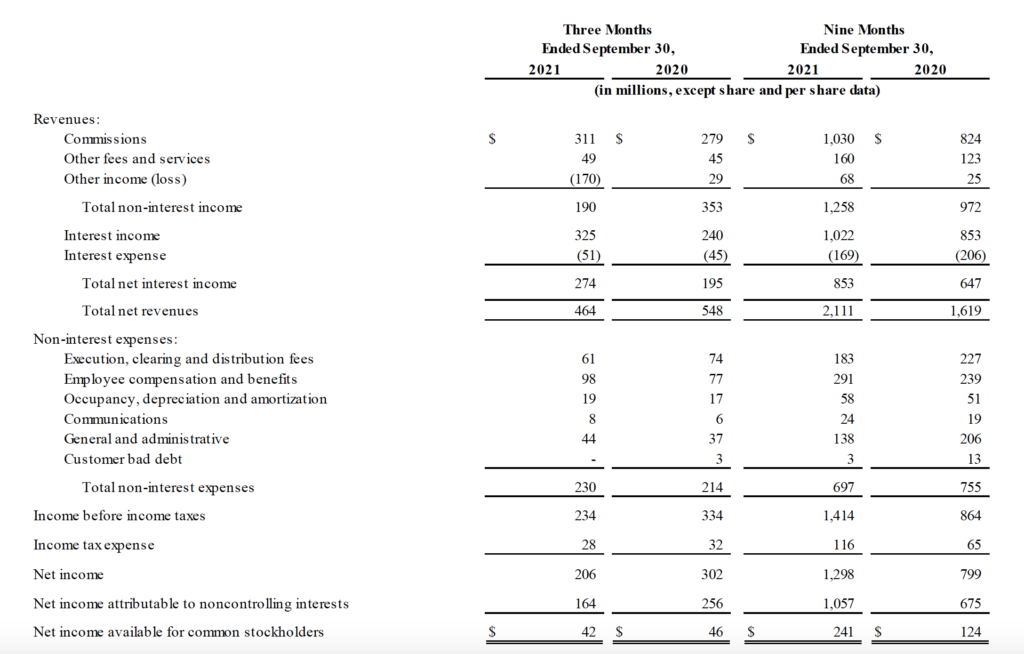

Net revenues were $464 million in the third quarter of 2021, down from $548 million a year earlier.

Income before income taxes was $234 million for the third quarter of 2021, compared to $334 million for the same period in 2020.

Commission revenue increased $32 million, or 11%, from the year-ago quarter on the back of higher customer stock and options trading volumes.

Net interest income increased $79 million, or 41%, from the year-ago quarter thanks to higher margin loan balances and strong securities lending activity.

Other income decreased $199 million from the year-ago quarter. This decrease was mainly comprised of:

- $191 million related to Interactive Brokers’ strategic investment in Up Fintech Holding Limited (Tiger Brokers), which decreased to a $185 million mark-to-market loss this quarter from a $6 million mark-to-market gain in the same period in 2020; and

- $30 million related to Interactive Brokers’ currency diversification strategy, which lost $3 million this quarter compared to a gain of $27 million in the same period in 2020; partially offset by

- the non-recurrence of a $13 million impairment loss on Interactive Brokers’ investment in OneChicago Exchange recognized in the year-ago quarter.

The Interactive Brokers Group, Inc. Board of Directors declared a quarterly cash dividend of $0.10 per share. This dividend is payable on December 14, 2021 to shareholders of record as of December 1, 2021.

Infinite games, infinite possibilities. Lucky Cola

Claim your throne in the virtual world – conquer every level Lodibet