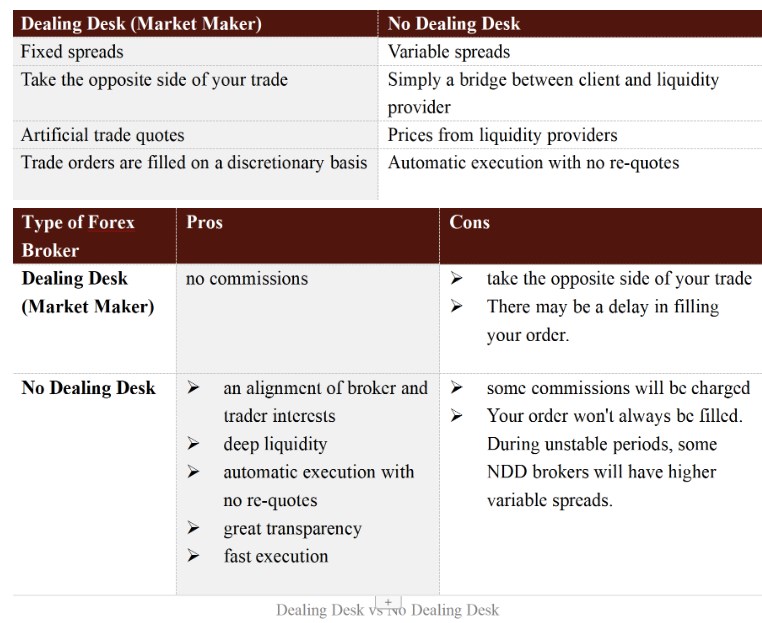

In the previous article, we mentioned “Dealing Desk Brokers = Market Makers?“, In this article, we learn more about the Differences between Dealing Desk & No Dealing Desk Forex Brokers

What is Dealing Desk brokers?

Dealing Desk (DD) brokers are also known as Market Makers because they provide liquidity to their clients, allowing them to execute their trades. They are brokers who take the opposite side of a client’s trades fix the bid and ask price and wait for the trader to place their order with their setup. The DD broker profits by buying at lower prices and selling at higher prices, and by taking advantage of spreads between bid and ask prices.

As shown in the figure below, a typical Dealing Desk Broker trade looks like this:

What is No Dealing Desk Forex Brokers

Brokers who use a No Dealing Desk (NDD) do not pass orders from their clients to a Dealing Desk. Instead, NDD brokers send orders directly to the forex market based on market prices that are not determined by them (via liquidity providers, banks, other brokers, etc.) . They have direct access to the interbank market. Everything is automatically executed when a client places a trade without human intervention.

As shown in the figure below, a typical No Dealing Desk Broker trade looks like this:

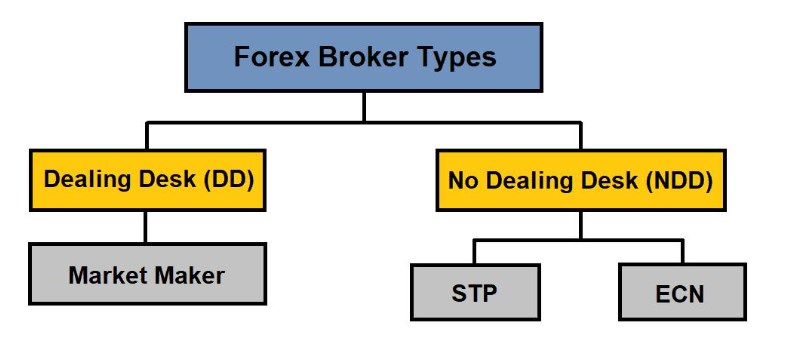

No Dealing Desk forex brokers can be divided into two types.

STP (Straight-Through Processing)

ECN (Electronic Communications Network)

STP (Straight Through Processing)

STP brokers route your trade orders directly to liquidity providers who have access to real-time interbank market rates. A no dealing desk STP forex broker typically works with several liquidity providers who quote bids and asks and execute forex trades for their clients. You get the best price in the forex market when you trade forex with an STP broker since they have variable spreads.

ECN (Electronic Communications Network)

Since ECN brokers allow market participants to trade directly with each other, they are generally the preferred broker style. Banks, institutions, hedge funds, and other retail traders are among these participants. By sending competing bids and offers into the system, all market participants trade against each other using the ECN model. Transparency is achieved by allowing your orders to interact with those of other traders.

You will be able to see where buys and sells are at all times with true ECN brokers. As a result, you can gauge how the market is positioned at the moment. As this type of broker passes the best price on to their clients, they must charge a commission, since they execute the trade at market price. Typically, commissions are low and are a fraction of the bid/ask spread.

Both STP brokers and ECN brokers provide the best bid/ask quotes. How can STP and ECN be distinguished? Compared to an STP broker, an ECN broker offers a wider range of prices and possibly tighter spreads.

Which Type of Forex Broker Should You Trade with?

What type of forex broker should you choose? A dealing desk broker? Or a no dealing desk broker? You decide! Both DD and NDD brokers have their advantages and disadvantages, as we have discussed above. Depending on your trading style and preferences, there isn’t one type of broker that is better than another. DD brokers offer wider spreads without commissions, while NDD brokers offer tighter spreads with commissions per trade.

As the market needs less ground to cover transaction costs, day traders and scalpers usually prefer tighter spreads. In contrast, traders who are interested in swings or positions for the long term tend to ignore wider spreads. As a result, there is no absolute answer to this question. One trader’s best choice may not be another’s. To choose a forex broker that is most suitable for you, you should take factors such as trading size, frequency, and service into consideration.

Trading Size

If you are a small retail trader, congratulations, you no longer have to worry about this question, because dealing desk forex brokers are your only option. Another question may disturb you, how can you tell whether or not a forex broker offers a dealing desk? The broker must have a dealing desk if it offers micro and mini lot orders. For more information on whether the broker offers STP or ECN access, you can also read the fine print and check reviews from other clients.

Re-quotes are often a concern for retail traders. When you click the deal button, the price changes, usually against you, and you are asked whether you want to proceed. Perhaps you should try another broker if this happens too often.

Trading Frequency & Service

There are two factors to consider when trading in multiples of 100k whole lots: trading frequency and service. The trading frequency will determine how much you pay in commissions, and a high level of activity may result in high commissions and bid/ask spreads that weigh heavily on your profit and loss. The tightest bid/ask spreads will be required by higher frequency, shorter-term traders. According to market conditions, bid/ask spreads vary. Although most DD brokers offer fixed spreads, they are wider than NDD brokers.

Conclusion

In a word, traders should always choose regulated brokers. In BrokersView, you can find more than than 2000+ forex brokers and 5000+ user reviews. If you want to become a successful forex trader, you should educate yourself enough and do more research on the brokers that you are interested in before you start trading. Visit our website (https://www.brokersview.com/) or download the BrokersView APP now to learn more about forex-related information and resources.