In a year which has been anything but normal, some normalcy has returned to the institutional FX trading market.

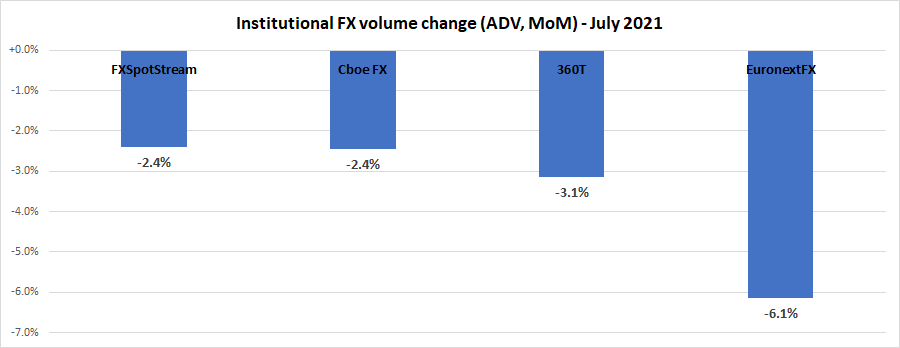

The normally slow summer months look like they will be – normally slow! Following a very strong but up-and-down first half of the year for leading institutional eFX venues, trading volume data for July show a slight decline averaging 4% for the month of July. All FX ECNs surveyed showed volumes down MoM from June of between 2% and 6%. Again, quite typical each year during July (and August), when many personnel on institutional trading desks are away on vacation.

Cboe FX (formerly HotspotFX)

- July 2021 average daily volumes were $32.68 billion, -2.4% MoM.

EuronextFX (formerly FastMatch)

- July 2021 ADV $18.17 billion, -6.1% below June’s ADV $19.35 billion.

FXSpotStream

- FXSpotStream’s ADV YoY (July ‘21 vs July ‘20) increased 18.55% to USD47.911billion

- FXSpotStream’s ADV MoM (July ‘21 vs June ‘21) decreased 2.40% to USD47.911billion

- FXSpotStream’s Overall Volume YoY (July ‘21 vs July ‘20) increased 13.39% to USD1.054trillion, crossing the USD1 trillion mark for the 5th time in the company’s history

- FXSpotStream’s ADV YTD (Jan-July ‘21 vs Jan-July ‘20) increased 15.10% to USD49.459billion when compared to the same period last year

360T

- Average daily volumes (ADV) at 360T came in at $21.3 billion in July, down 3.1% from June’s $22.0 billion.

I’ve been searching for hours on this topic and finally found your post. slotsite, I have read your post and I am very impressed. We prefer your opinion and will visit this site frequently to refer to your opinion. When would you like to visit my site?