The assets of Silicon Valley Bank (SVB), which failed on Friday after the financial catastrophe more than ten years ago, were confiscated by US authorities. SVB, the 16th-largest bank in the nation, catered to customers like IT professionals and businesses with venture capital funding. Because of their worry about the bank’s position, many of its clients took money this week, which left the bank unable to handle the sizable withdrawals. The bank eventually collapsed despite efforts to collect additional money. As part of its duty to protect assets, the Federal Deposit Insurance Corporation (FDIC) assumed control of the bank and its administration. Although it may not be well-known to the general public, SVB was one of the biggest banks in the US as of the end of 2022, with $209 billion in assets and roughly $175.4 billion in savings. SVB excelled in funding start-ups.

Software Workers Are Getting More Nervous

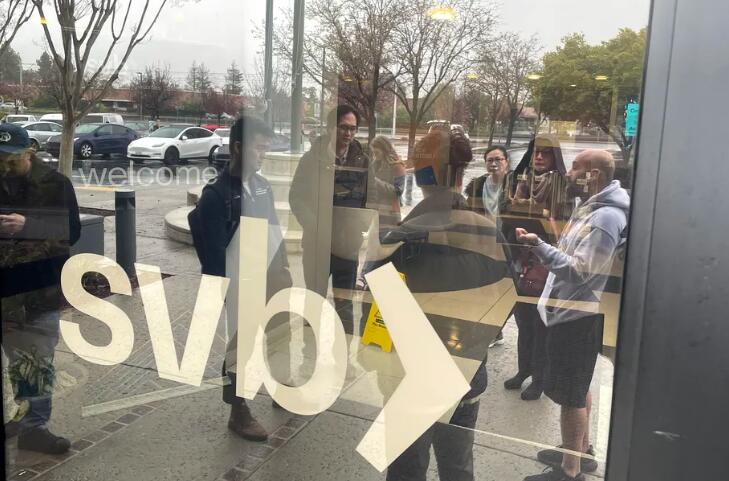

The loss of Silicon Valley Bank ranks as the second-largest failure of a US retail bank after that of Washington Mutual in 2008. US Treasury Secretary Janet Yellen met with financial officials on Friday to discuss the situation. She reassured them that she believed them to take the necessary action and emphasized the fortitude of the banking industry. Customers who were worried about accessing their money congregated in front of the Santa Clara offices in California. They were instructed to begin withdrawing up to $250,000 (€235,000) on Monday by an FDIC notification. High-deposit venture investors voiced worry about the state of affairs, including a start-up CEO who was worried about his workers’ paychecks. The bank’s collapse came after it was revealed that it had lost money totaling $1.8 billion (€1.7 billion) despite selling $21 billion (€19.7 billion) in financial assets and failing to generate capital fast enough to manage client transactions. Investors were taken aback by the development, which rekindled concerns about the security of the entire banking sector. This was especially true given the recent sharp increase in interest rates, which is devaluing bonds and driving up credit costs. On Thursday, the four biggest US banks dropped $52 billion (€49 billion) on the stock market, which had negative effects on Asian and European institutions.

Lasting Impacts Outside the US

Following the financial disaster that struck Silicon Valley Bank (SVB), the second-largest private bank failure in the US since the collapse of Washington Mutual in 2008, European and US institutions are now confronting sizable losses. The fear started when SVB declared it needed to rapidly raise capital to handle huge client withdrawals, but failed to do so, leading to the selling of $21 billion worth of financial assets and a $1.8 billion loss. Because of the sharp increase in interest rates, which decreased the value of the assets in their inventories and raised the cost of loans, the news reignited concerns about the stability of the financial industry. Big Wall Street banks bounced back on Friday, but smaller institutions and those that catered to a particular clientele experienced more turbulence. Experts predict that large banks face a low risk of a capital or liquidity event; however, the failure of SVB has put the bank under unusual financing pressure.